ANKERSTAR WEALTH

About Us

At Ankerstar Wealth, we’re here to help you take control of your financial future. With advanced technology and a strategy-driven approach, we manage and grow your portfolio with precision, ensuring your financial success.

Young Professionals

Beginning your career, whether fresh from college or with some experience, often involves managing immediate priorities. We’re here to help you enjoy the lifestyle you’ve earned, manage debts, and strategically invest to build a prosperous future.

Business Owners

If you're passionate about entrepreneurship, you know its unique rewards and demands. Our financial planners can help structure your finances to support your business goals, allowing you to focus on what you do best—growing your business.

New Families

With a new family, income may drop while expenses increase. We’re here to support you during this busy time, helping you plan for today while securing the future. Let us be your financial partner, managing your family’s needs now and as they grow.

Raising Older Children

As your children grow, so does your financial landscape. While your income is likely at its peak, so are the costs associated with supporting young adults at home or in college. We’ll help you maximize your earnings, prioritize paying off your mortgage, and strategically invest any additional funds to secure your future while supporting your family.

Preparing for Retirement

Everyone approaches retirement in their own way, but within five to ten years of your target retirement date, it’s time to start maximizing every paycheck. We’ll help refine your financial strategy to make the most of these final working years, setting you up for a smooth transition into retirement with confidence in your financial future.

Living in Retirement

Even after retirement, we’re here as your trusted financial partner. Our wealth management strategies help ensure you continue to enjoy the lifestyle you’ve built, with room for a few indulgences. Retirement often includes estate planning, and consulting with us on your legacy can provide you peace of mind, knowing your hard-earned assets are set to benefit the people you care about most.

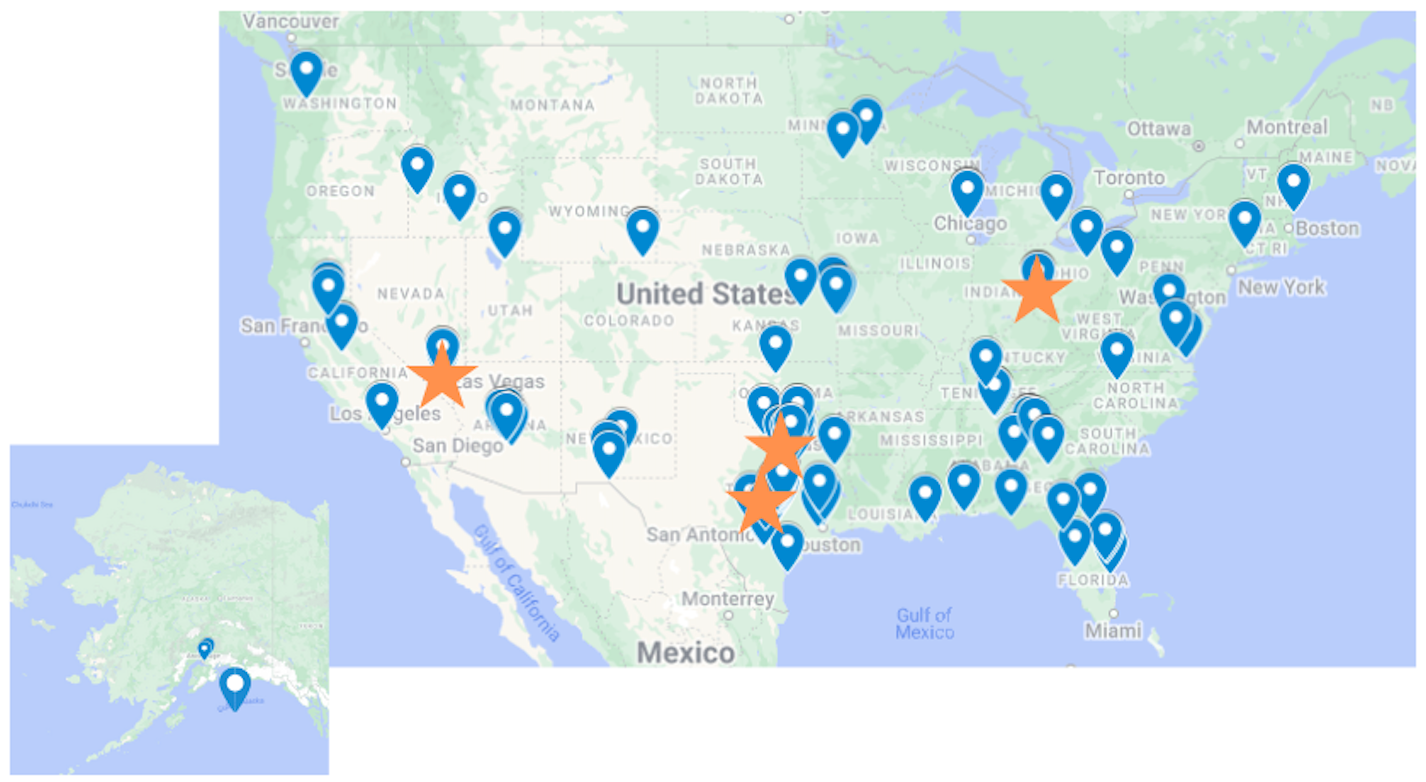

We serve clients like you across the United States!

Our Heritage

Founded in 2013 by Steve Ankerstar, a retired Air Force officer, we started as Afterburner Financial, a wealth management firm in Round Rock, Texas, focused on the upper-middle class. In 2021, we rebranded to Ankerstar Wealth to expand into a broader professional investment space. Now, we serve clients across the nation, from financial planning in Florida to retirement planning in Arizona, and everywhere in between.

Achievements by the numbers

30-50%

growth every year since ankerstar wealth's inception

$130+

million

IN ASSETS UNDER MANAGEMENT

300+